1 | Add to Reading ListSource URL: oag.gov.btLanguage: English - Date: 2016-04-18 02:10:10

|

|---|

2 | Add to Reading ListSource URL: www.barc.gov.inLanguage: English - Date: 2015-06-09 07:05:16

|

|---|

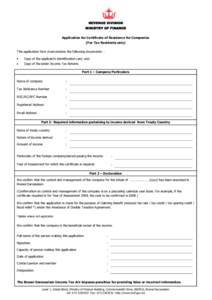

3 | Add to Reading ListSource URL: www.cpcb.nic.inLanguage: English - Date: 2014-12-19 05:00:45

|

|---|

4 | Add to Reading ListSource URL: www.fastfacts.co.inLanguage: English - Date: 2013-07-03 12:43:47

|

|---|

5![Form No. 27Q [See sections 194E, 195, 196A, 196B, 196C, 196D and rule 31A and 37A] Quarterly statement of deduction of tax under sub-section (3) of section 200 of I.T. Act, 1961 in respect of payments other than Salary m Form No. 27Q [See sections 194E, 195, 196A, 196B, 196C, 196D and rule 31A and 37A] Quarterly statement of deduction of tax under sub-section (3) of section 200 of I.T. Act, 1961 in respect of payments other than Salary m](https://www.pdfsearch.io/img/6aa4d0d872f5940d4001b2ca429df23b.jpg) | Add to Reading ListSource URL: www.fastfacts.co.inLanguage: English - Date: 2013-07-03 12:43:46

|

|---|

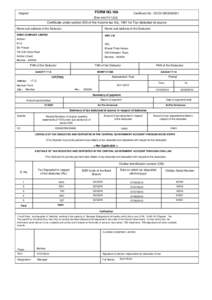

6![FORM NO.16A [See ruleb)] Certificate under section 203 of the Income-tax Act, 1961 for Tax deducted at source Name and address of the Deductor Name and address of the Deductee FORM NO.16A [See ruleb)] Certificate under section 203 of the Income-tax Act, 1961 for Tax deducted at source Name and address of the Deductor Name and address of the Deductee](https://www.pdfsearch.io/img/65e3070056ab1cb5a5ae17ae4b58baba.jpg) | Add to Reading ListSource URL: www.fastfacts.co.inLanguage: English - Date: 2013-07-03 12:43:46

|

|---|

7 | Add to Reading ListSource URL: www.stars.gov.bnLanguage: English - Date: 2015-03-29 21:29:24

|

|---|

8![Form No. 26Q [See sections 193, 194, 194A, 194BB, 194C, 194D, 194EE, 194F, 194G, 194H, 194-I, 194J, 194LA and rule 31A] Quarterly statement of deduction of tax under sub-section (3) of section 200 of the Income-tax Act, Form No. 26Q [See sections 193, 194, 194A, 194BB, 194C, 194D, 194EE, 194F, 194G, 194H, 194-I, 194J, 194LA and rule 31A] Quarterly statement of deduction of tax under sub-section (3) of section 200 of the Income-tax Act,](https://www.pdfsearch.io/img/caa0f213afa75c3098d426b47bbee42c.jpg) | Add to Reading ListSource URL: www.fastfacts.co.inLanguage: English - Date: 2013-07-03 12:43:46

|

|---|

9![“FORM NO.16 [See rulea)] PART A “FORM NO.16 [See rulea)] PART A](https://www.pdfsearch.io/img/2a592831c3b5f3ed16f2b110d07ec63d.jpg) | Add to Reading ListSource URL: www.fastfacts.co.inLanguage: English - Date: 2013-07-03 12:43:46

|

|---|

10 | Add to Reading ListSource URL: 220.227.161.86Language: English - Date: 2014-02-27 01:41:21

|

|---|