1 | Add to Reading ListSource URL: www.stats.indiana.eduLanguage: English - Date: 2007-04-12 09:39:48

|

|---|

2 | Add to Reading ListSource URL: nicoa.org- Date: 2015-02-12 11:53:18

|

|---|

3 | Add to Reading ListSource URL: revenue.mt.govLanguage: English - Date: 2014-01-09 10:48:33

|

|---|

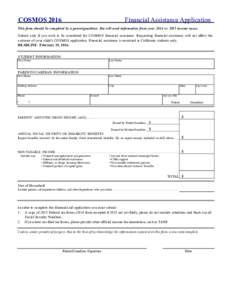

4 | Add to Reading ListSource URL: cosmos-ucop.ucdavis.eduLanguage: English - Date: 2015-12-30 13:57:11

|

|---|

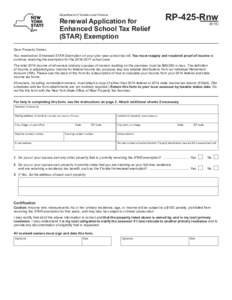

5 | Add to Reading ListSource URL: townofclayton.comLanguage: English - Date: 2015-07-22 12:34:00

|

|---|

6 | Add to Reading ListSource URL: riseupms.comLanguage: English - Date: 2016-05-10 14:19:53

|

|---|

7 | Add to Reading ListSource URL: www.lltcpa.comLanguage: English - Date: 2016-08-12 18:53:04

|

|---|

8 | Add to Reading ListSource URL: www.seattlefoundation.orgLanguage: English - Date: 2016-03-04 13:39:28

|

|---|

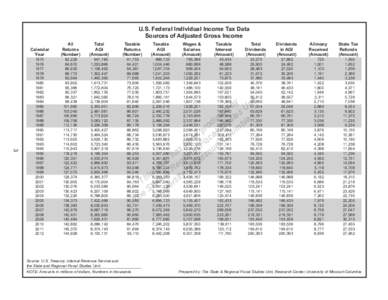

9 | Add to Reading ListSource URL: eparc.missouri.eduLanguage: English - Date: 2015-02-06 15:24:41

|

|---|

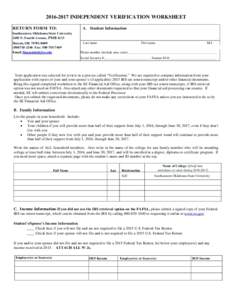

10 | Add to Reading ListSource URL: www.se.eduLanguage: English - Date: 2016-04-07 16:04:47

|

|---|