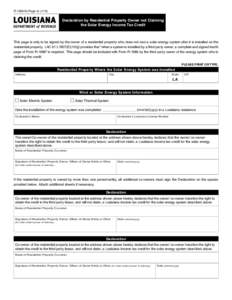

991 | Add to Reading ListSource URL: revenue.louisiana.gov- Date: 2014-11-12 15:02:51

|

|---|

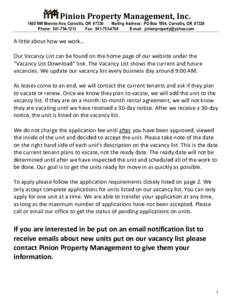

992 | Add to Reading ListSource URL: pinionproperty.com- Date: 2016-11-28 15:04:56

|

|---|

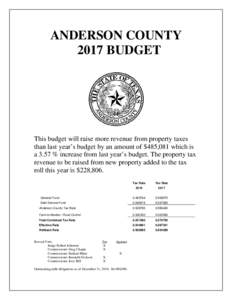

993 | Add to Reading ListSource URL: tools.cira.state.tx.us- Date: 2016-09-08 11:52:37

|

|---|

994 | Add to Reading ListSource URL: pdf.euro.savills.co.uk- Date: 2016-09-19 03:26:44

|

|---|

995 | Add to Reading ListSource URL: www.gpo.gov- Date: 2016-10-28 00:41:49

|

|---|

996 | Add to Reading ListSource URL: www.comptroller.texas.gov- Date: 2016-12-02 15:42:38

|

|---|

997 | Add to Reading ListSource URL: gcpld.org- Date: 2016-12-05 17:22:40

|

|---|

998 | Add to Reading ListSource URL: tools.cira.state.tx.us- Date: 2016-08-08 17:43:34

|

|---|

999 | Add to Reading ListSource URL: tools.cira.state.tx.us- Date: 2016-08-10 13:08:07

|

|---|

1000 | Add to Reading ListSource URL: create.extension.org- Date: 2016-10-13 14:51:11

|

|---|