1 | Add to Reading ListSource URL: www.bakertillycayman.comLanguage: English - Date: 2014-11-03 12:22:02

|

|---|

2 | Add to Reading ListSource URL: srb.europa.euLanguage: English - Date: 2015-12-23 05:42:46

|

|---|

3 | Add to Reading ListSource URL: www.unsiap.or.jpLanguage: English - Date: 2016-08-08 01:08:55

|

|---|

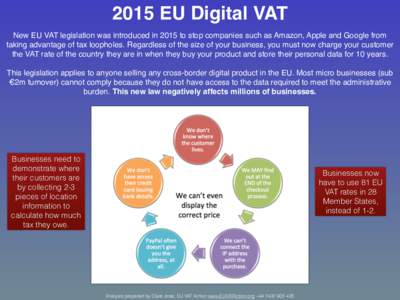

4 | Add to Reading ListSource URL: euvataction.orgLanguage: English - Date: 2015-02-23 12:12:50

|

|---|

5 | Add to Reading ListSource URL: www.swiss-economics.chLanguage: English - Date: 2011-03-11 03:20:20

|

|---|

6 | Add to Reading ListSource URL: news.pwc.chLanguage: English - Date: 2016-07-01 05:58:27

|

|---|

7 | Add to Reading ListSource URL: www.vivaafricallp.comLanguage: English - Date: 2016-04-22 12:15:30

|

|---|

8 | Add to Reading ListSource URL: www.grantthornton.luLanguage: English |

|---|

9 | Add to Reading ListSource URL: www.amcham.geLanguage: English - Date: 2016-07-07 09:13:09

|

|---|

10 | Add to Reading ListSource URL: www.customs.gov.mvLanguage: English - Date: 2014-09-28 02:17:00

|

|---|